Will There Be A Federal Tax Credit For Electric Cars In 2020

Here are the currently available eligible vehicles. December 1 2020 - To get the federal EV tax credit you have to buy a new and eligible electric car.

Tesla Gm Lose Bid To Raise Ceiling For Federal Ev Tax Credit

If you purchase a new all-electric or plug-in hybrid you may be eligible for a federal income tax credit of up to 7500.

Will there be a federal tax credit for electric cars in 2020. A new bill to reform the federal electric car tax incentive in the US has passed the US Senate Finance Committee. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle i. Yes it is absolutely possible.

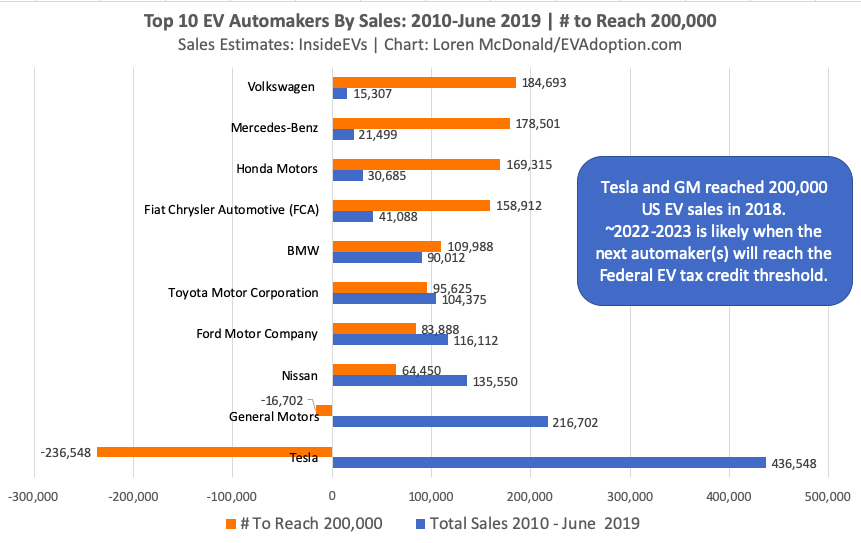

Currently Congress has set the phase-out limit of electric cars sold at 200000 units per manufacturer. The credit amount will vary based on the capacity of the battery used to power the vehicle. 343 Zeilen Federal Tax Credit Up To 7500.

The credit provides up to 7500 in a tax credit when you claim an EV purchase on taxes filed for the year you acquired the vehicle. See the IRS instructions for Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit - httpswwwirsgov. After that the credit begins to phase out for that manufacturer.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. It includes increasing the electric vehicle tax credit to up to 12500 but it. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year.

Here General Motors would be the biggest winner as the automakers allotment of tax credits expired completely in 2020. This is not a once in a lifetime credit. 4 Once you purchase your car youll simply file form 8936 with your tax returns.

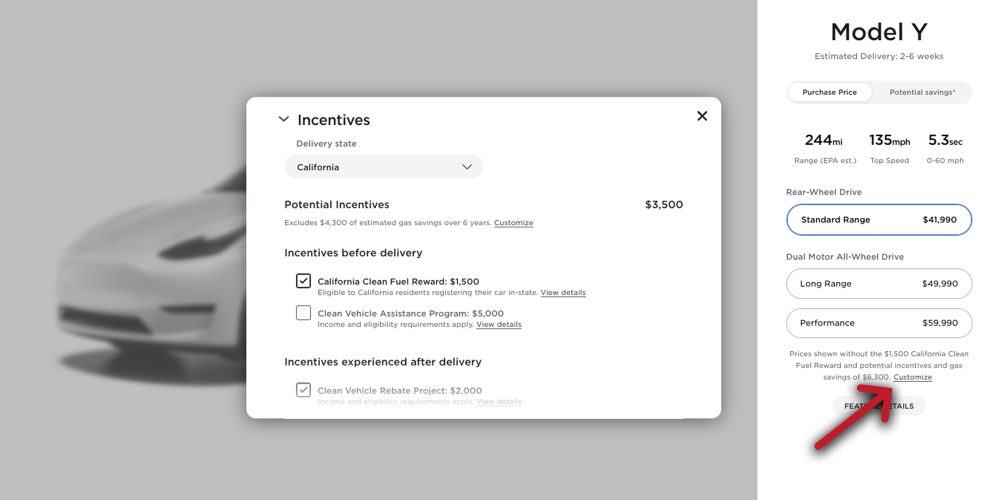

Its important to note that you are only eligible for the credit if youve purchased a new car. From 2020 you wont be able to claim tax credits on a Tesla. Among other things the proposal increases the maximum tax credit for an electric car to 12500 though there are several tiers to this.

If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000. Electric cars are entitled to a tax credit if they qualify. Claiming the Federal Tax Credit.

It applies to plug-in hybrids or PHEV and plug-in electric EV or PEV vehicles. The Qualified Plug-In Electric Drive Motor Vehicle Credit can be worth up to 7500 in nonrefundable credit. In short automakers that have met the threshold already would have access to a new 7000 tax credit for 400000 additional electric vehicles until a new phase-out period starts again.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. So if you bought an EV this year in 2021 you would claim the. To see what cars qualify and what their current tax credits are in the US check out the official list at fueleconomygov.

But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500. Yes if you purchase the eligible electric vehicle during the tax year you can use the credit for that tax year. Yes most electric cars are still eligible for this tax credit.

You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. The IRS will not go over and above this total tax. After July 1 st until the end of the year the credit is only worth 1875.

All EVs receive a 7500 credit with an. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. With this legislation GM would.

Luckily none of the eligible plug-in cars have reached that 200000 mark yet so your tax credit will mostly be based on which electric vehicle you decide to purchase. If the credit reduces your tax liability to zero any further credit is lost.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

How Do Electric Car Tax Credits Work Kelley Blue Book

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Understanding The Electric Vehicle Credit Strategic Finance

How Do Electric Car Tax Credits Work Credit Karma

Smart Ev Buyer Guide For Minnesotans December 2020 Edition Fresh Energy

Buying An Electric Car For Savings Time Could Be Of The Essence Valuepenguin

Electric Vehicle Tax Credits What You Need To Know Edmunds

Charged Evs Proposed Legislation Would Restore Federal Ev Tax Credit To Gm And Tesla Charged Evs

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Your Guide To The Chevy Volt Tax Credit

Electric Vehicles Tax Credit For 2020 By Car Model

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Electric Hybrid Car Tax Credits 2021 Simple Guide Find The Best Car Price

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Post a Comment for "Will There Be A Federal Tax Credit For Electric Cars In 2020"